Three High-Yield Dividend Stocks Offering Up To 9.1% Returns

Despite recent volatility in the tech sector and mixed performances across major US indices, the Dow Jones Industrial Average has demonstrated resilience with its sixth consecutive session of gains. In this environment, investors might consider the stability offered by high-yield dividend stocks, which can provide regular income streams and potential cushion against market fluctuations.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.12% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 4.95% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.07% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.96% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.86% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.86% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 5.93% | ★★★★★☆ |

West Bancorporation (NasdaqGS:WTBA) | 5.75% | ★★★★★☆ |

Southside Bancshares (NasdaqGS:SBSI) | 5.24% | ★★★★★☆ |

Union Bankshares (NasdaqGM:UNB) | 5.68% | ★★★★★☆ |

Click here to see the full list of 202 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

BCB Bancorp

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BCB Bancorp, Inc., a bank holding company for BCB Community Bank, provides banking products and services to businesses and individuals in the United States, with a market capitalization of approximately $178.90 million.

Operations: BCB Bancorp, Inc. generates its revenue primarily through its banking operations, totaling approximately $100.03 million.

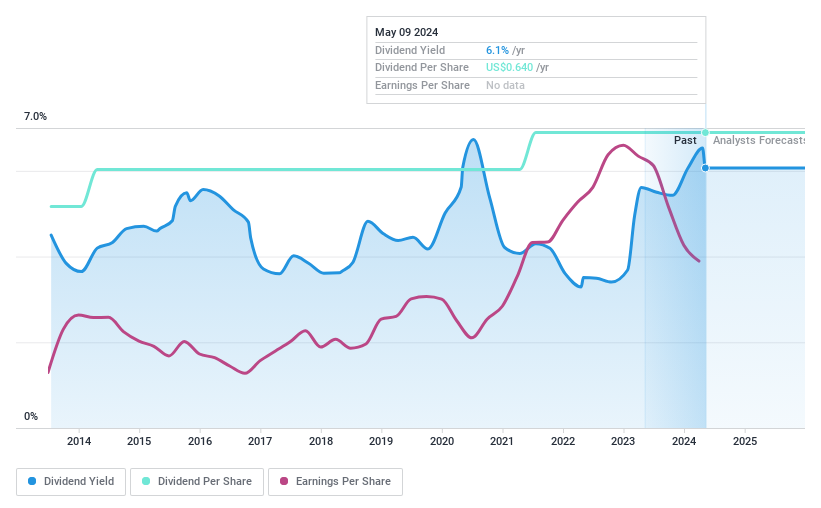

Dividend Yield: 6.1%

BCB Bancorp offers a compelling dividend yield of 6.07%, ranking in the top 25% of US dividend payers. The stock trades at a significant discount, approximately 62.4% below its estimated fair value, suggesting potential undervaluation relative to intrinsic worth. Dividend sustainability is supported by a moderate payout ratio of 41.1%, indicating that earnings adequately cover distributions with room for financial flexibility. Historically, dividends have not only been stable but also exhibited growth over the past decade, enhancing its appeal to income-focused investors despite some data gaps on long-term payout coverage and recent declines in quarterly earnings and net interest income as reported on April 19, 2024.

Ardmore Shipping

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ardmore Shipping Corporation operates globally, specializing in the seaborne transportation of petroleum products and chemicals, with a market capitalization of approximately $734.43 million.

Operations: Ardmore Shipping Corporation primarily generates its revenue from the global maritime transport of petroleum products and chemicals.

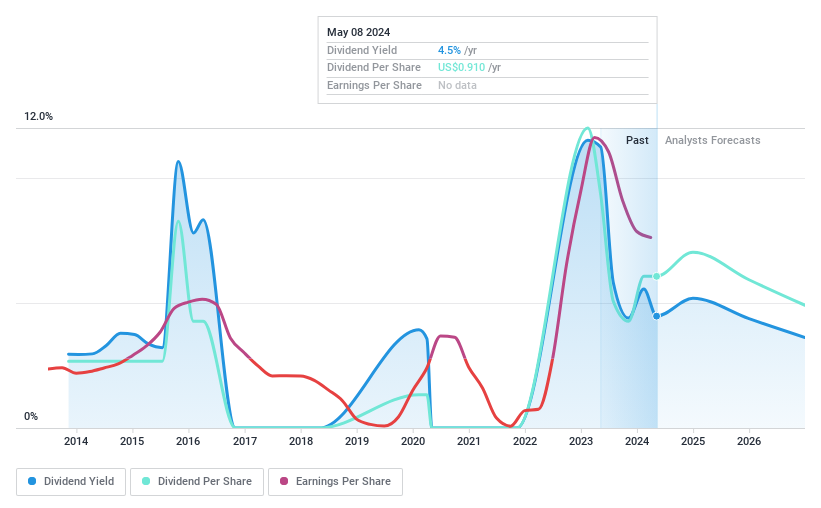

Dividend Yield: 4.5%

Ardmore Shipping Corporation recently declared a quarterly dividend of US$0.31 per share, payable in June 2024, reflecting a commitment to returning value to shareholders despite a recent downturn in earnings and sales for Q1 2024. While the company's dividends are well-covered by both earnings and cash flow, with payout ratios of 21.3% and 32% respectively, its dividend yield remains slightly below the top quartile for U.S. stocks at 4.47%. However, Ardmore’s dividend history shows variability over the past decade, indicating potential concerns about the stability and reliability of future payouts amidst an expected decline in earnings over the next three years.

Our valuation report unveils the possibility Ardmore Shipping's shares may be trading at a discount.

International Seaways

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: International Seaways, Inc., a company that owns and operates a fleet of oceangoing vessels for the transportation of crude oil and petroleum products in the international flag trade, has a market capitalization of approximately $3.01 billion.

Operations: International Seaways, Inc. generates its revenues primarily from two segments: Crude Tankers, which brought in $524.01 million, and Product Carriers, which earned $547.77 million.

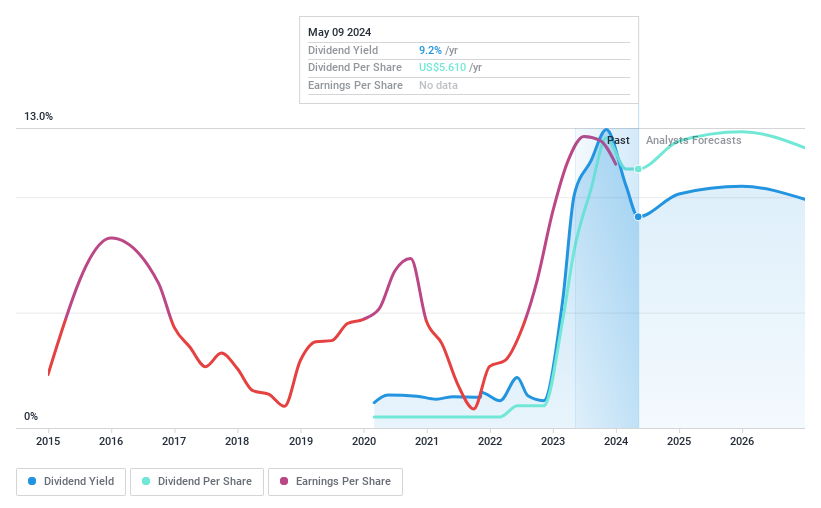

Dividend Yield: 9.2%

International Seaways recently declared a regular quarterly dividend of US$0.12 and a special dividend of US$1.63 per share, both payable in June 2024. These dividends are supported by a cash payout ratio of 57.1%, indicating reasonable coverage by cash flows despite the company's volatile dividend history over the past four years and an unstable track record since it began paying dividends less than a decade ago. The recent filing for a shelf registration suggests potential future capital raising activities, which could impact financial strategies including future dividends.

Key Takeaways

Embark on your investment journey to our 202 Top Dividend Stocks selection here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGM:BCBP NYSE:ASC and NYSE:INSW.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com